do nh residents pay sales tax on cars

If you are a New Hampshire resident registering your vehicle in New Hampshire you do not pay sales tax in Vermont. New Hampshire is one of the few states with no statewide sales tax.

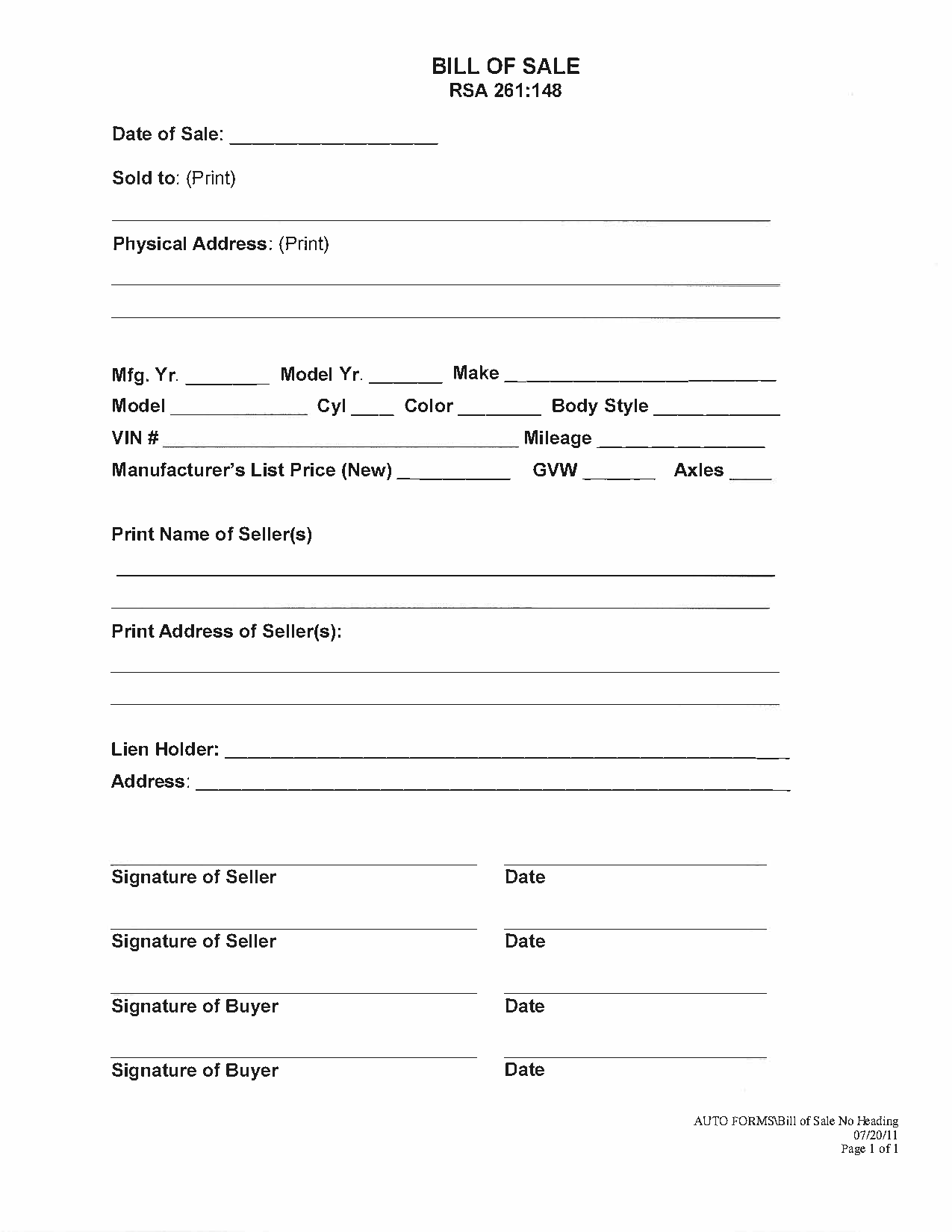

How To Sell A Car In New Hampshire The Dmv Rules For Sellers

What kind of taxes do you pay in New Hampshire.

. This is just one of the wonderful things about being a resident of this beautiful state. Purchase location does not determine sales tax for a vehicle state of registration does. If you purchase a vehicle in New Hampshire but register it in another state you must pay sales tax for the state of registration.

The answer depends on whether the resident paid any sales tax to the state in which the vehicle was purchased. The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is 0. How much is excise tax on a car in MA.

New Hampshire does not charge sales tax on vehicles. However if you live in neighboring Vermont Maine or Massachusetts you cannot simply go to New Hampshire to buy a car to avoid paying sales tax. No you will not save sales tax.

You only pay tax in the state that you register the vehicle. Only five states do not have statewide sales taxes. New Hampshire residents do not pay sales tax on a vehicle purchase.

Sales tax to do that CA will not refund even though you are a NH resident just picking it up from the manufacturer. N ew Hampshire is one of just five states that do not have a sales tax so youre in luck when you need to purchase a vehicle. If you buy a car in New Hampshire and then register it in New Hampshire as a NH resident you will pay no sales tax.

Do you pay tax on cars in NH. The answer is unequivocally no you will not have to pay Vermont sales tax when purchasing a car if you do not live in Vermont. And not only will you not pay Vermont sales tax if you live in New Hampshire or Massachusetts we will take care of the paperwork necessary for you to purchase your vehicle here and get it back.

These excises include a 9 tax on restaurants and prepared food consumed on-premises a 9 tax on room and car rentals a tax of 000055 cents per megawatt-hour on. But if you buy it in NH and then register it in another state you will have to pay that state the sales tax. New Hampshire residents do not pay sales tax on a vehicle purchase.

If you buy a car in a state other than your home state the car dealer will usually collect your sales tax at the time of purchase and send it. Do you pay tax on cars in NH. So assuming you buy a 60K vehicle the taxes registration fees look like this.

Connecticut charges 635 sales and use tax on purchases of motor vehicles that cost 50000 or less and 775 sales and use tax on motor vehicles that cost more than 50000 CGS 12-4081A H and 12-4111A H. If you are a New Hampshire resident registering your vehicle in New Hampshire you do not pay sales tax in Vermont. You dont have to pay sales tax on a used car in New Hampshire because there is no car sales tax.

Montana Alaska Delaware Oregon and New Hampshire. The excise rate is. New Hampshire is one of just five states that do not have a sales tax so youre in luck when you need to purchase a vehicle.

As long as you are a resident of New Hampshire you wont need to pay sales tax on the purchase of your car even when you go to register it. 18 first year 15 next lowering to 03 in year 6 and beyond. However if you live in neighboring Vermont Maine or Massachusetts you cannot simply go to New Hampshire to buy a car to avoid paying sales tax.

Based on the NH numbers you basically pay a reducing of original sales price annually. However if you live in neighboring Vermont Maine or Massachusetts you cannot simply go to New Hampshire to. There are however several specific taxes levied on particular services or products.

As long as you are a resident of New Hampshire you wont need to pay sales tax on the purchase of your car even when you go to register it. For more information on motor vehicle fees please contact the NH Department of Safety. A 9 tax is also assessed on motor vehicle rentals.

I was also told that the address on the buyers drivers license must be identical to the Registration. This is just one of the wonderful things about being a resident of this beautiful state. As long as you are a resident of New Hampshire you wont need to pay sales tax on the purchase of your car even when you go to register it.

You do not have to pay sales tax when you register a car in New Hampshire. New Hampshire is one of just five states that do not have a sales tax so youre in luck when you need to purchase a vehicle. You do not have to pay sales tax when you register a car in New Hampshire.

Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85. You might save some on transportation cost but you are obligated to pay California 6000. However if you live in neighboring Vermont Maine or Massachusetts you cannot simply go to New Hampshire to buy a car to avoid paying sales tax.

You will pay the MA sales tax as use tax when you register the car. Unfortunately unless you register the car in the sales-tax-free state you will still have to pay the sales tax when you register the vehicle with your home states DMV. New Hampshire is one of just five states that do not have a sales tax so youre in luck when you need to purchase a vehicle.

Can I buy car in New Hampshire live in Massachusetts. Same for any tax-free state. As long as you are a resident of New Hampshire you wont need to pay sales tax on the purchase of your car even when you go to register it.

Motor vehicle fees other than the Motor Vehicle Rental Tax are administered by the NH Department of Safety.

What S The Car Sales Tax In Each State Find The Best Car Price

New Hampshire Vehicle Sales Tax Fees Find The Best Car Price

New Gmc Terrain For Sale In Concord Nh Near Manchester Nh

Sheet Of 50 22 Cents Novajo Art Stamp Sheet Scott2235 38 Etsy Usps Stamps Vintage Postage Stamp

Free New Hampshire Motor Vehicle Bill Of Sale Form Pdf Word

New Hampshire Vehicle Sales Tax Fees Find The Best Car Price

New Hampshire Vehicle Sales Tax Fees Find The Best Car Price

Understanding New Hampshire Taxes Free State Project

How To Buy A Car In Another State Tulley Mazda In Tulley Nh

Sheet Of 50 10 Cents 200 Years Of Postal Service Trains And Etsy Usps Stamps Vintage Postage Postal

New Hampshire Vehicle Sales Tax Fees Find The Best Car Price

Cost Of Living In New Hampshire How Does It Stack Up Against The Average Salary

New 2016 Lance 1050s Truck Camper Truck Camper Camper Trucks

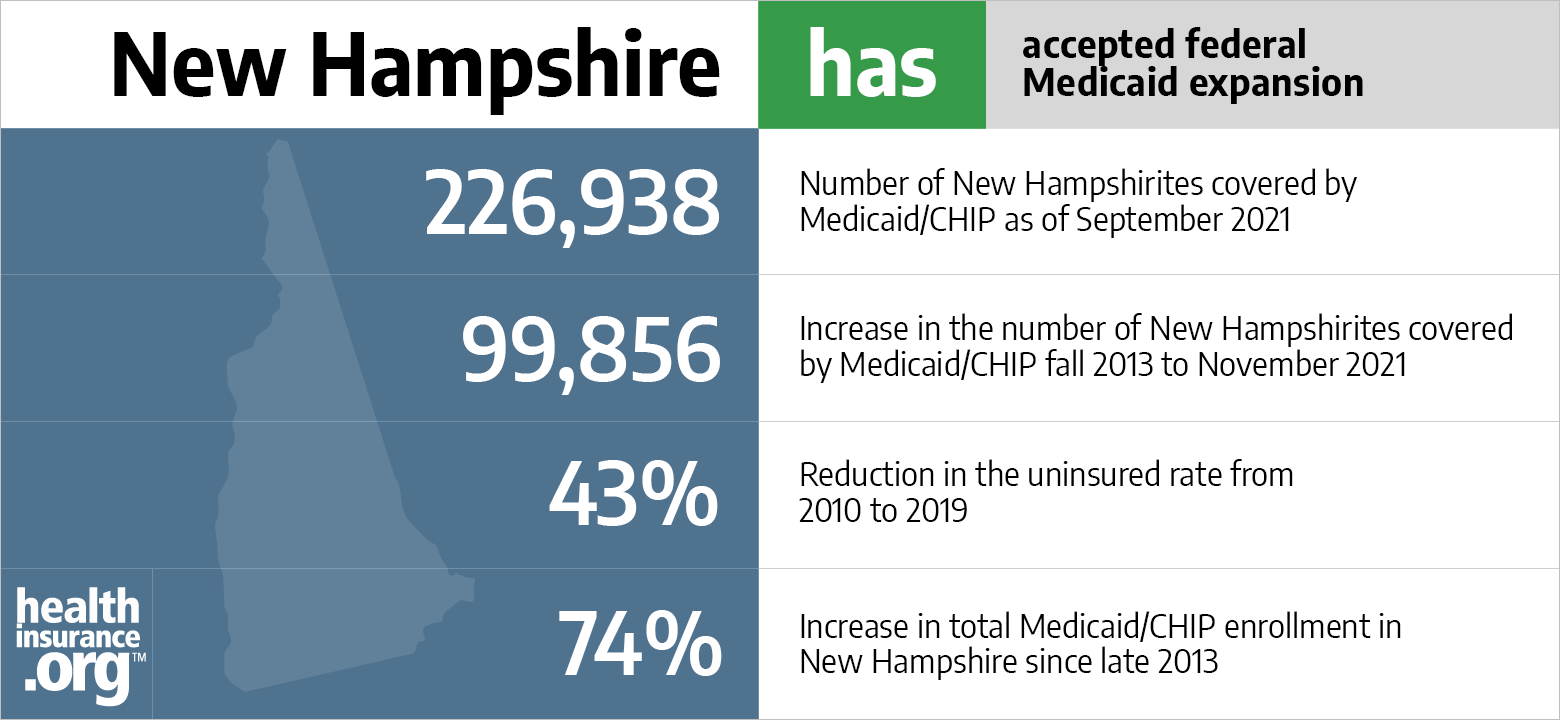

Aca Medicaid Expansion In New Hampshire Updated 2022 Guide Healthinsurance Org

New 2017 Lance 1172 Truck Camper At Campers Inn Merimmack Nh 21174 Truck Camper Camper Pickup Camper

Pin On Vintage Us Postage Stamps Posted And Unposted Mint

2017 Ford Transit Cargo 250 3dr Lwb Medium Roof Cargo Van W Sliding Passenger Side Door 27 977 Ford Transit Used Ford Ford

Free Realtor Flyer Templates Real Estate Flyer Template Flyer Free Brochure Template